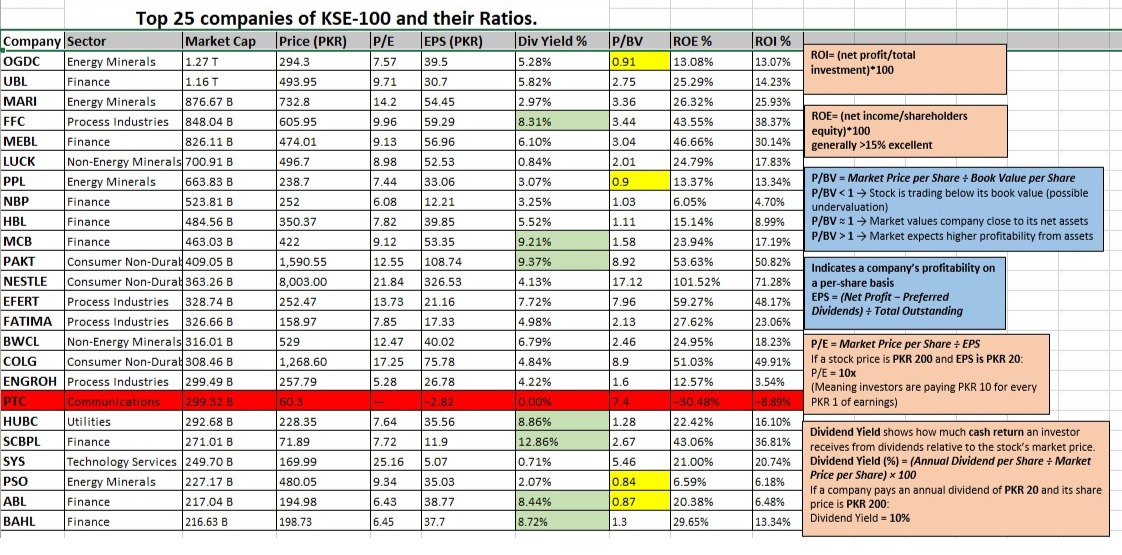

You don’t need to be a stock market expert to make informed investment decisions. While the market often feels like a whirlwind of tips and noise, the most successful investors rely on a simple truth: the numbers do the talking. By looking at a snapshot of the top 25 KSE-100 companies, we can strip away the complexity and focus on the data that actually drives wealth.

The Three Pillars of Smart Investing

When analyzing the KSE-100 data, your goals should dictate which numbers you prioritize. Whether you want a steady paycheck or long-term growth, these metrics are your roadmap:

- Value (Finding Bargains): Metrics like P/E (Price-to-Earnings) and P/BV (Price-to-Book Value) tell you if a stock is on sale. A P/BV of less than 1 suggests a stock is trading below its book value, indicating possible undervaluation.

- Profitability (The Engine): ROE (Return on Equity) measures how effectively a company uses shareholder money to generate profit; generally, an ROE above 15% is considered excellent.

- Income (Passive Cash Flow): Dividend Yield shows the annual cash return you receive relative to the stock price.

Aligning Data with Your Goals

Good investing is not a one-size-fits-all approach. It is a matter of choosing between income vs. growth and stability vs. risk:

- For the Income Seeker: Look for high Dividend Yields in stable sectors like Finance (e.g., UBL or MCB).

- For the Value Hunter: Focus on Energy Minerals like OGDC or PPL, where the P/BV is below 1, suggesting the market may be overlooking their true asset value.

- For the Growth Enthusiast: Prioritize companies with high ROE and strong EPS, such as MEBL or LUCK, which demonstrate the ability to turn capital into significant profit.

Investors’ takeaway

Investing is only complicated when you chase the noise. By sticking to a disciplined, data-driven strategy, you can move away from guesswork and toward a portfolio that aligns with your financial goals.

Are you looking to build a portfolio for regular income, or are you hunting for undervalued stocks to hold for the long term? Knowing your goal is the first step; letting the numbers guide you is the second.

.png)